Join us in building a leading European brand in high-end Medical Cannabis

STENOCARE has been admitted to Nasdaq First North Growth Market Denmark and now invites its shareholders and new investors to participate in a Rights Issue with proceeds of up to DKK 45 million that will be used to further accelerate the company’s European leadership in the new Medical Cannabis industry, which is expected to experience hyper growth in the coming years.

Investment Highlights

1

First mover

2

Profitable business

3

Fully scalable

4

Strong assets to win

“

“STENOCARE is now a leader in the European market; its production and distribution network in Denmark was profitable […by end] 2018 and is currently expanding to Ireland among other emerging markets.”

The European Cannabis Report, February 2020, Edition Five

”

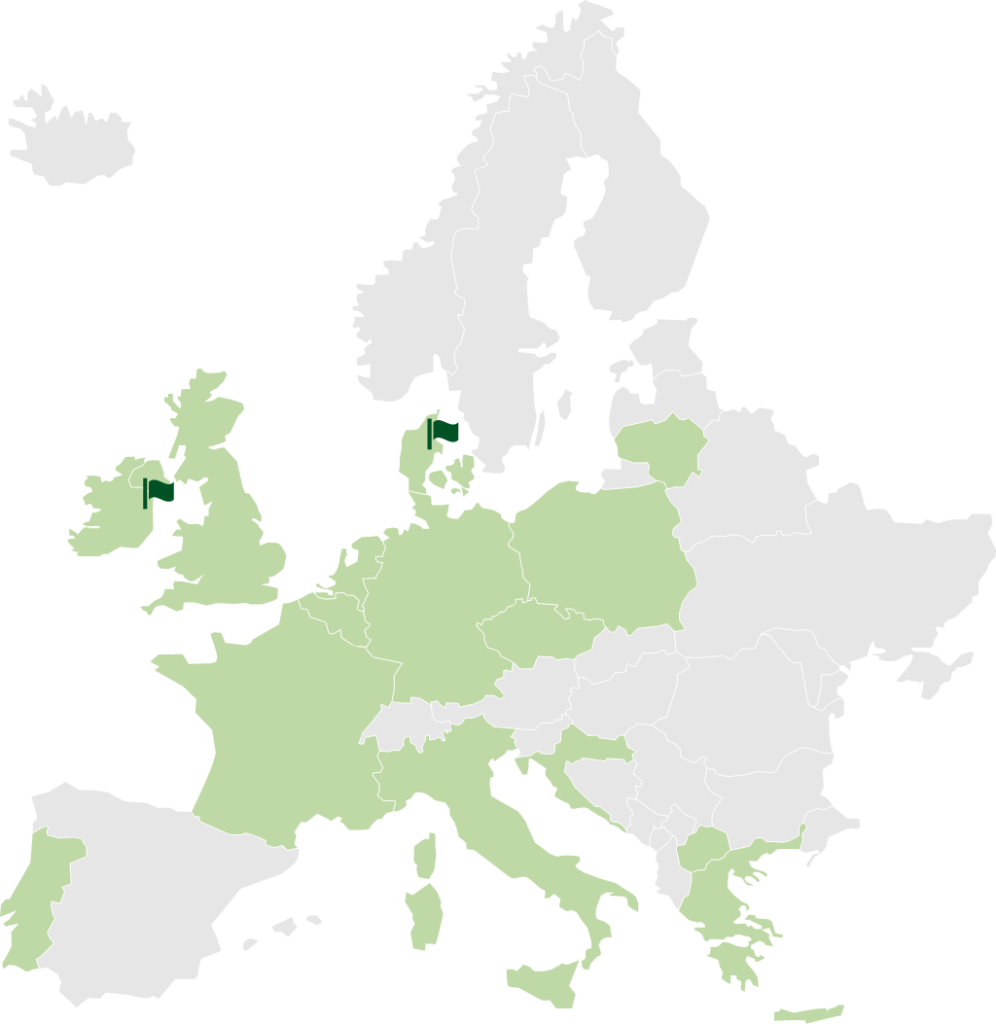

STENOCARE addresses a European market expected to grow to EUR 2.2 billion by 2024.

Green = Countries having legalized medical cannabis in some form

STENOCARE is present in Randers, Denmark, and in Dublin, Ireland

Medical Cannabis is prescribed for many types of illnesses

The Danish Medicines Agency has made an assessment concerning which patient groups and treatment indications they primarily recommend being treated with Medical Cannabis. These are: multiple sclerosis (MS), chronic pain, spinal cord injury (paraplegia) and nausea and vomiting as a result of chemotherapy.

There is a total of about 40+ indications in which Medical Cannabis may potentially show results in terms of efficacy (see list – source: Leafly).

ADD / ADHD

ALS

Alzheimer’s

Anorexia

Anxiety

Appetite loss

Arthritis

Asthma

Bipolar

Cachexia

Cancer

Chrohn’s

Cramps

Depression

Diabetes

Epilepsy

Fatigue

Fibromyalgia

Gastrointernal disorders

Glaucoma

HIV / AIDS

Hypertension

Inflammation

Insomnia

Migraine / headache

Multiple Sclerosis

Muscular Dystrophy

Nausea

OCD

Osteoperosis

Pain

Parkinson’s

Phantom limb

PTSD

Seizures

Sleep Apnea

Spasticity

Spinal injury

Stress

Tourette’s

Successful first mover with solid execution of STENOCARE 1.0

Recently, STENOCARE was named a leader in the European cannabis market in the European Cannabis Report February 2020 issue. This industry approval is solid testament to the quality of execution and delivery on managements’ initial first-mover strategy from 2018, STENOCARE 1.0. It has brought the company to a position today, where it is ready to commence the next chapter and scale its business – in Denmark and internationally.

Ambitious from day 1

Founded in 2017 by a highly experienced management team, STENOCARE set out to become a clear first-mover in prescription-based Medical Cannabis under the Danish Pilot Programme which commenced on 1 January 2018. This target has now been achieved.

Most successful IPO

In October 2018, STENOCARE was listed on Spotlight Stock Market as the first ever IPO of a licensed provider of Medical Cannabis in Europe. The listing drew widespread international media attention and was named as “the best IPO in Sweden in 2018” by the leading financial media SvD BörsPlus and oversubscribed by more than 21x. Since then, STENOCARE has met all major targets set out in STENOCARE 1.0.

A well-established first mover

STENOCARE was the first company to gain licenses relating to cultivation, manufacturing, import and distribution from the Danish Medicines Agency (DMA) – widely recognized for imposing probably the strictest regulatory regime in the world. As a result, STENOCARE was the first to deliver its branded and licensed Medical Cannabis oil products to more than 2,000 patients in Denmark.

Systematic and scalable

STENOCARE has gained invaluable knowledge of how Doctors prescribe, and patients use Medical Cannabis and the practice of products and dosage. STENOCARE has implemented Good Manufacturing Practice (GMP) and completed regulatory inspections with the DMA – therefore, all workflows and operations are formally documented in Standard Operating Procedures (SOP). International growth of the business such as the establishment of STENOCARE Ireland Ltd., is hence executed on a solid foundation allowing the company to scale with growing volume and complexity.

New products in the pipeline and multiple-supplier strategy in place

After the termination of the agreement with its previous supplier, STENOCARE has secured its first new suppliers, Canadian company Emerald Health Therapeutics and Israeli company Panaxia Pharmaceutical Industries. While the termination impacted sales negatively for some quarters, STENOCARE has emerged stronger with new products, already submitted for approval by the authorities to restart the supplies to the market. In addition to new and better products, the company has also gained access to a wide selection of advanced Medical Cannabis products targeted for the growing and diverse group of patients.

First harvest in place

STENOCARE has completed its first harvest without the use of pesticides at the small-scale cultivation facility in Denmark. This success was made possible by a strategic decision to cultivate plants in a highly-controlled indoor facility with all critical parameters throughout the cultivation process closely monitored and controlled.

First to make a profit

And last but not least, STENOCARE became profitable by year-end 2018, just months after its commercial introduction to the market. It remained profitable throughout 2019 when STENOCARE was one of very few profitable companies in the European Medical Cannabis industry.

A WORD FROM OUR CEO

Setting sails to become a winner in European Medical Cannabis

On behalf of STENOCARE, I am pleased to announce our company’s ambitious plan for international market leadership at scale and our ambition to grow into a Nasdaq Small-Cap company.

Moving forward, the STENOCARE 2.0 strategy is about leveraging all the company assets and accelerating the execution to become a winner in the new Medical Cannabis industry in Europe. Being recognized already as a European market leader only amplifies our drive to push harder and confirms that we have a real chance to capture a significant part of the future, multi-billion-euro market for high-end Medical Cannabis in Europe.

Our STENOCARE 2.0 strategy is about just that. Essentially, we raise our ambition, in relation to production, research partnerships and international market positions, and certainly also in terms of building a leading quality brand. The key elements of the strategy are:

Geographical expansion up to 10 markets by 2025

Our ability to be compliant with the advanced and highly-demanding pharma-style regulatory regime for Medical Cannabis in Denmark provides a significant barrier to competition. We expect this strict regime to be copied by other European markets, and our ability to work with the authorities will hence prove to be a valuable asset. Our immediate target is to be active in two countries outside Denmark by end-2020, including Ireland, and to be operating in up to 10 markets by 2025.

Own production: Pharma-grade ready in 2021

Upgrading our existing production facility, we are constructing a larger-scale in-door production facility combining the best technology from greenhouse and indoor productions. When fully operational and approved in 2021, the facility enables both premium products at scale and our own “sandbox” to develop and test cultivation and production of Medical Cannabis with pharma-grade uniformity and documentation.

Advanced products ready in 2021/22

We have established the first pharma-grade development partnership with Solural Pharma to develop new, advanced Medical Cannabis oil products with global exclusivity. This marks an important step towards building a true quality leader in pharma-grade Medical Cannabis.

One-stop quality supplier from 2022

STENOCARE aims to build an attractive and diverse product portfolio of high-quality Medical Cannabis products sourced from own production, strategic suppliers and specially formulated products that target specific conditions to meet the needs of a large, diverse patient group.

Igniting the STENOCARE 2.0 strategy, we have decided to move STENOCARE’s listing to Nasdaq First North Growth Market and initiate a Rights Issue. By applying for admission to Nasdaq First North Growth Market, we will become associated with a strong internationally recognized platform and take the first step towards a subsequent upgrade to the SmallCap market at Nasdaq Copenhagen.

I invite our shareholders and new investors to participate in our Rights Issue on Nasdaq First North. Even though we have a cash reserve, we find that now is a good time to accelerate our ambitious goals, thereby staying ahead of the competition. We intend to use the proceeds from the Rights Issue to build financial strength and take full advantage of our market position and the strong underlying growth which is currently unfolding in Europe to build the leading European brand for Medical Cannabis for the benefit of shareholders, patients and society in general.

Thomas Skovlund Schnegelsberg

CEO, STENOCARE

Leading European brand in high-end medical cannabis

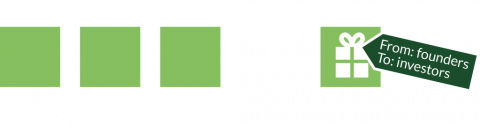

Buy three [3] New Shares at DKK 20 each and receive one [1] additional existing share free of charge

STENOCARE is moving its listing to Nasdaq First North Copenhagen and invites its +4,000 shareholders (in Sweden and Denmark) and new investors to participate in a Rights Issue transaction with expected gross proceeds of up to DKK 45 million.

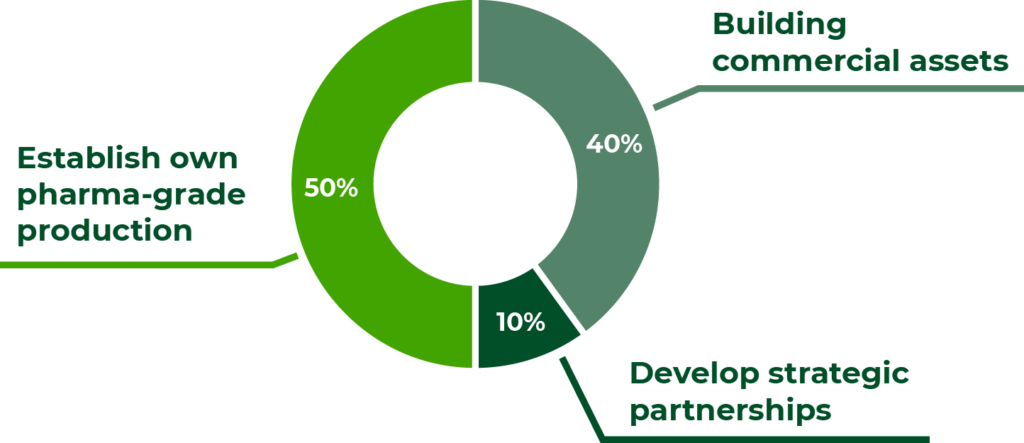

Use of funds

The proceeds will be dedicated to creating a leading European brand within Medical Cannabis with a distinct and unique high-end pharma-grade approach by:

A) Building commercial assets

40% for international scale-up: building further commercial assets by expanding to up to 10 markets with local licenses and distribution of own branded products, including cash reserve;

B) Develop strategic partnerships

10% for advanced products: create strategic research and development partnership assets from advanced formulations and products that can raise the bar in terms of medical effect and precision; and

C) Establish own pharma-grade production

50% for own state-of-the-art cultivation at scale: establishing own end-to-end pharma-grade production and extraction at scale.

How the offering works

Buying 3 shares at DKK 20 each and receiving one for free means that you will have four shares at an average price of DKK 15/each. To calculate the real discount you must then compare with the market price of the share

Everybody can subscribe and everybody buying New Shares receives bonus shares free of charge from the Founders of STENOCARE. Most of the share issue is allocated to GENERAL SUBSCRIPTION, and you need not be an existing shareholder to buy.

GENERAL SUBSCRIPTION: Everybody, including new investors and existing shareholders, can participate in the open, general subscription. This is done directly in your bank on-line (or by contacting your bank manager). Alternatively, you can complete the Subscription Form without rights (see link below) and send it to your bank. Payment takes place after allocation on June 15.

SUBSCRIPTION WITH RIGHTS: Existing shareholders that wish to exercise their subscription rights and anyone wanting to buy extra rights to be sure about allocation can do so via their bank. Payment takes place automatically on purchase. All shareholders as per May 26 EOB will have subscription rights corresponding to their holding of shares and have priority in case of an oversubscription.

For more detailed information on the Rights Issue and how to subscribe, please visit

Buy 3 shares and get 1 extra for free

For every three (3) New Shares subscribed for at DKK 20 each, subscribers will receive one Bonus Share free of charge from the Founders – adding up to four (4) shares in total.

Example: Subscribe three New Shares and get one existing for free

Pre-emptive subscription rights for shareholders

Existing shareholders are entitles to subscribe for one (1) new offer share at a fixed market prices of DKK 20, for every six (6) existing shares.

Example: 18 subscription rights triggers a right to buy 3 New Shares

“By offering this Rights Issue with pre-subscription rights to existing shareholders and a free Bonus Shares delivered by the Founders for each three shares that you buy, we wish first of all to acknowledge our base of +4,000 shareholders. At the same time, with our new listing on Nasdaq First North Growth Market Denmark, we hope to welcome many more, new investors to take part in the STENOCARE 2.0 journey”.

Thomas Skovlund Schnegelsberg,

Co-Founder and CEO, STENOCARE A/S.

Main offer conditions for the New Shares

DKK 20,00 per share

All Existing Shareholders at the end of the Record date will receive Subscription Rights (1 per share). Six (6) Subscription Rights are required to subscribe for one New Share in the Rights Issue.

For every three (3) New Shares subscribed for, subscribers receive one Bonus Share free of charge from the Founders.

DKK 178.9 million. 8,942,762 shares at DKK 20 per share.

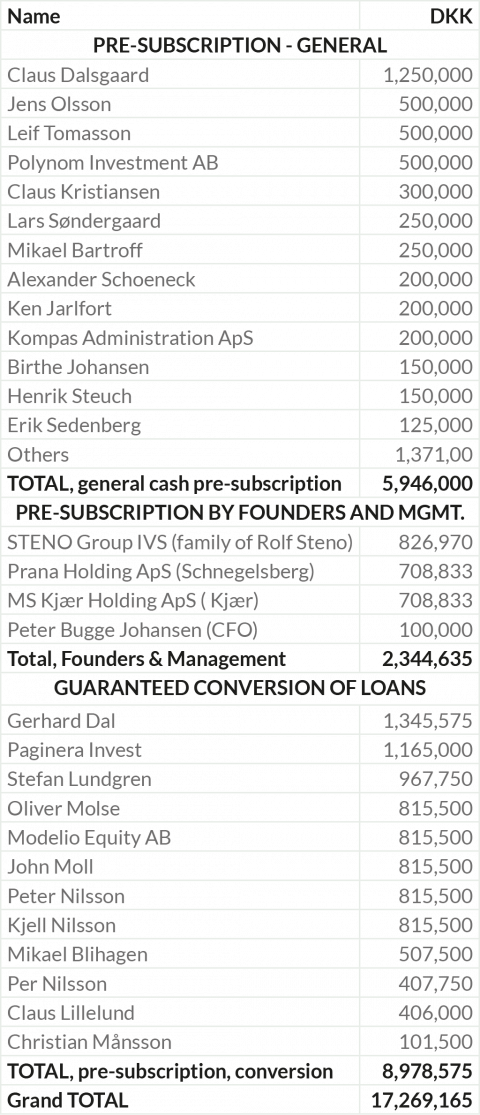

The total pre-subscription is DKK 17.3 million or 58% of the Rights Issue.

DKK 44.8 million gross and DKK 41.5 million net after cost.

on Nasdaq First North Growth Market Denmark

STENOCARE is admitted to trading on Nasdaq First North Growth Market Denmark and will be delisted from Spotlight Stock Market. The share is unchanged and carries the same stock ticker: [STENO] and permanent ISIN code: DK0061078425 in VP Securities.

Temporary Shares: DK0061272317 (not traded, will solely be used to subscribe for the New Shares). Subscription Rights: DK0061272234 (traded, no value if unused).

The New Shares will also be traded on Nasdaq First North Growth Market Denmark.

Subscription in general as well as subscription for and trading in Subscription Rights is undertaken through your bank, in accordance with the subscription instructions given by the bank. For practical information and more detailed instructions about how to subscribe, please visit: https://stenocare.com/investor-relations/share-issue-2020/

Important dates

Subscription commitments for DKK 17.3 million or 58% of Rights Issue

STENOCARE has obtained presubscription commitments from 35 Danish and Swedish in- vestors for approximately DKK 17.3 million.

Important information

This brochure does not constitute an offer to purchase shares but should be seen only as an introduction to STENOCARE A/S’ (“STENOCARE’s”) Right Issue. This brochure does not necessarily contain all information required in order to make an investment decision. Prospective investors are advised to read the Prospectus dated May 11, 2020 before making any decision regarding an investment in order to fully understand the investment case. It is advised to study the entire Prospectus and the terms and potential risks associated with the decision to invest in STENOCARE in particular, as described in Sections 3 “Risk factors” and 5.2 “Plan and distribution and allotment” of the Prospectus. The Prospectus is available on STENOCARE’s website. Terms used and referred to in this document with Caps refer to terms established in the Prospectus.